The FAVR code, as defined by the IRS, is simply a way to calculate the cost of owning and operating your vehicle where you live and work. Kliks brings you our innovative FAVR solution where you are in control.

FAVR with more admin power and no annual contracts

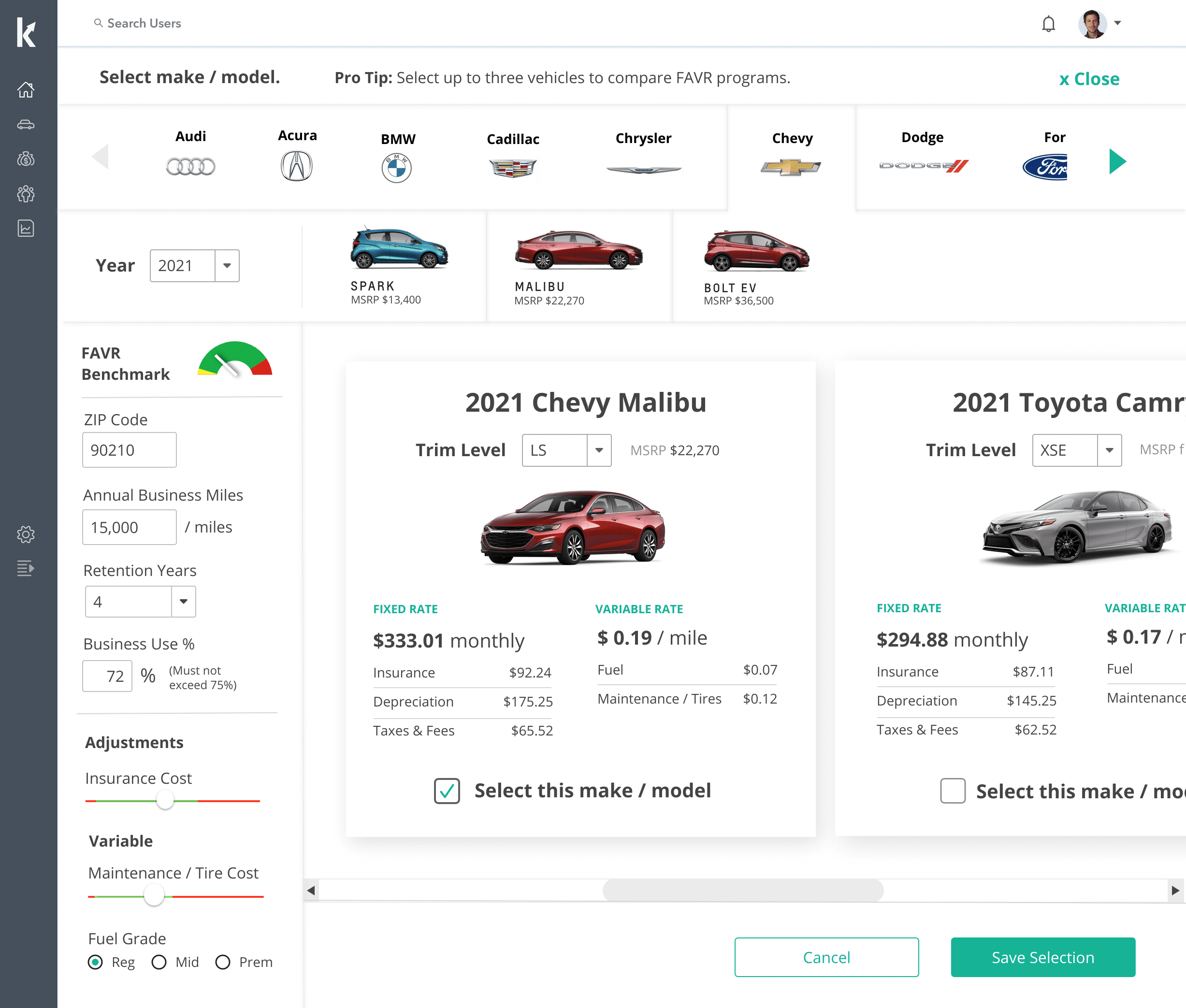

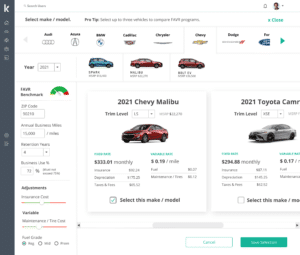

AI-Powered Rate Calculation

Define rates by base vehicle and any location.

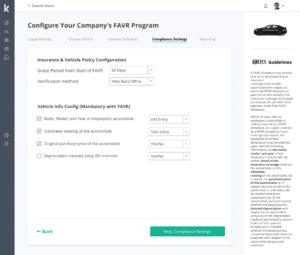

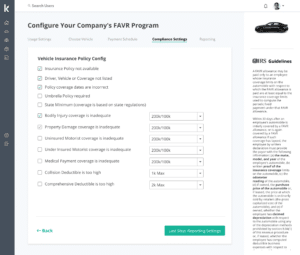

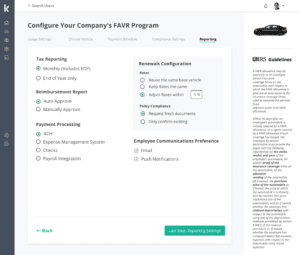

Complete Control at the Admin Level

Unlike other solutions, you. have complete control over your reimbursement program.

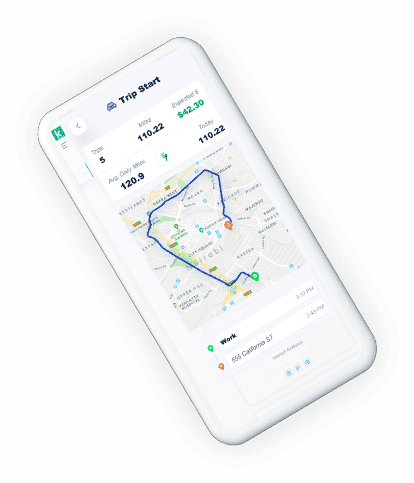

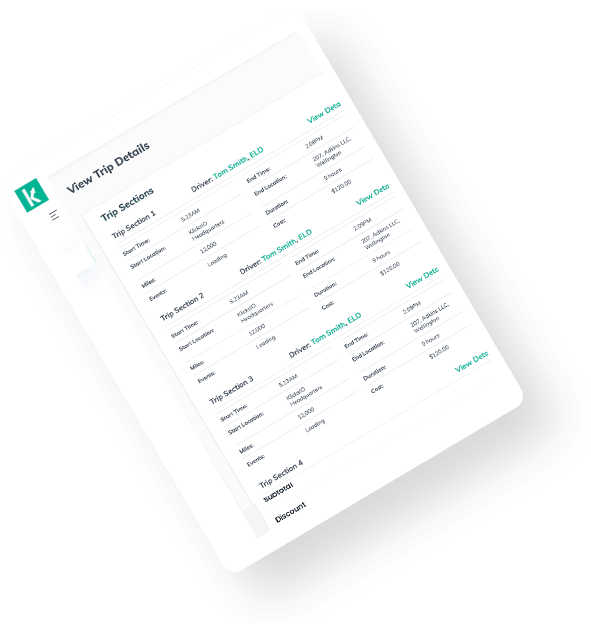

Record Trips on iOS or Android

A battery-efficient mobile app that just works.

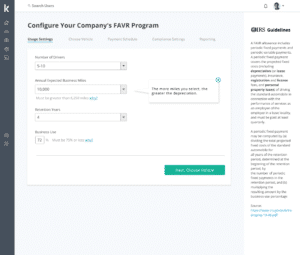

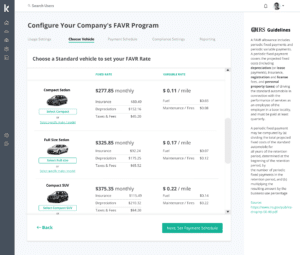

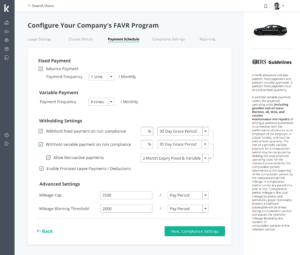

Define Your Reimbursement Rules

Automate reimbursements with flexible payment schedules and adjustments.

Driving and maintaining a personal vehicle for business has everything to do with location

How it works

The Challenge

How do you pay your employees fairly based on where they live and work?

The cost of living and operating a vehicle differs from city to city, gas, maintenance, insurance, etc. FAVR by the IRS takes all this into account so that you can reimburse fairly. This has tax benefits for the employee and savings for you

Solution

Individualized reimbursement for unique circumstances. Folding all the factors into a comprehensive solution. Sound complicated? Kliks FAVR makes it easy by streamlining the data into a user-friendly, IRS-compliant mileage tracking engine.

Accommodate your employees, your budget, your schedule, and the taxman. Simplify where it counts with Kliks FAVR.

Full support for Electric Vehicles (EVs)

Deriving rates for EVs comes with its own set of challenges and complexity. At Kliks given our ethos on sustainability and a greener planet we have put significant effort into putting together baseline rates for EV electric charging costs based on location and utility company used.